Global Founders' Headache #5: Cash Management Tips for Startups

Guidance on how to safely store your VC money and manage treasury for startups operating across borders.

Just landed your first multi-million funding round? Boom, exciting!

How many of you know how to manage this money beyond controlling your burn?

I am talking about managing FX, currency devaluation, the risk of temporary or permanent bank or infrastructure failure, overnight change of regulations, frozen bank account, high inflation, or even considering putting to work your extra cash with low-risk interest-bearing accounts or government-issued short-term securities.

Nobody tells you what to do with your cash once you have closed your round.

If you operate in a market with high currency fluctuation it is business-critical to be on top of your cash management. In any other market, you want to understand and implement basic enterprise risk management.

Why?

In case another an SVB-like black swan event happens,

or more likely, embezzlement, fraud, phishing,

or even likelier, employee mistakes,

or down the line, to optimize your treasury.

You would expect your world-class VCs, seasoned from supporting legendary companies around the globe, to provide insightful advice.

Well, some would argue that building unicorns and scalable governance are conflicting priorities VCs and founders pursuing 100x returns cannot be bothered with.

Just do your homework to save time, and let’s go! You're not expected to become a hedge fund trader. You need to know enough to mitigate risks and build (some) cash management policies and governance within your company.

I am intentionally being a tiny bit sarcastic to keep you entertained and encourage you to learn about another admin topic.

My point is that in the early stage of your ventures, it benefits you to be aware of these topics and to be proactive in setting the foundations for scaling.

I know you thrive in chaos 💥 🖤…

…but if you want to save yourself some headaches, keep reading to learn 7 tips to manage cash as a global founder:

Don’t put all your eggs in one basket —> diversification 🍳

Build relationships with human bankers —> people 💙

Raise money with a VC in your market —> experience 🌍

Funds for your projected net cash outflow should be available —> liquidy 💧

Generate interest on your idle cash, but keep in mind that you are not an investment professional —> safeguard 🛟

Manage FX but avoid complex hedging or trading —> currency management 📈 Bonus: get 10 tips from experienced CFOs.

Elevate support functions (legal and finance) —> operational excellence 🏆

Hopefully, this blog post helps to reduce your blind spots about this daunting yet critical topic: cross-border cash management. Use it as your roadmap to identify and hire the best talents to scale your business globally by building rock-solid support teams. As always, read these tips through the lenses of your business needs — making business-driven decisions is key.

To illustrate the topic, I considered a startup fundraising in the U.S. and operating in emerging markets (in Africa for example 😉). The reasoning should be pretty similar for other countries/jurisdictions.

Tip 1: Don’t put all your eggs in one basket 🍳

Money opens doors, allowing you to diversify your assets and mitigate risks associated with relying on any single bank, currency, or country.

Diversify banks and accounts

Primary bank account with a neobank

The business banking experience has improved significantly over the past ten years. To move fast, neobanks for startups, like Mercury or Brex, are a no-brainer choice to open your first bank account in the U.S. They’ve toughened up their KYC checks for foreign founders (read my previous blog post on incorporation). However, it is still much faster and smoother than opening a bank account with a traditional bank.

Learning from the SVB failure, check whether a bank is a member of FDIC (Federal Deposit Insurance Corporation) on their website and its deposit insurance coverage. The standard maximum deposit insurance amount is $250k per depositor. As a comparison, in Europe, it’s usually around $100k.

If you've raised millions, consider banks in a “sweep network” (i.e. a partnership between banks across the U.S.) that can extend coverage up to 20x per bank.

For example, Mercury offers startups up to $5M in FDIC insurance. They’ve precisely designed their product to meet startup founders' needs for more proactive cash and treasury management (learn more here). I genuinely love Mercury products — I don’t have any affiliation with them.

Secondary bank account with another neobank or traditional bank

You can combine multiple neobanks to ensure access to cash for your operating expenses in case anything happens (and benefit from the many perks they offer to attract new users - thanks VC money). This is also a way to increase the FDIC insurance coverage.

If you are transacting with countries in emerging markets I would get at least 2 neobank accounts, in case they shut down one of your accounts.

If you raised a few million, you do want to consider also opening a traditional bank account with a Global Systemically Important Bank (G-SIB), such as Bank of America, JP Morgan, HSBC, BNP Paribas (you can check the full G-SIB list for 2023 here). Above $5M, this is a no-brainer and you’ll be treated like a queen.

You are pretty safe with two neobanks and one traditional bank.

Create sub-accounts

As your business grows, it is also a good practice to open sub-accounts with a designated purpose to keep things clean and organized and allow for better cash flow monitoring and management.

Diversify currency holding

Maintaining balances in major currencies is a good practice for any company (EUR, USD, GBP). This is particularly relevant if you operate in a market where you have to manage high currency volatility (see Tip 6).

Remember that you are not expected to optimize for every dollar by trading currencies.

The general rule is to bank with financial institutions that provide multiple currency bank accounts.

Diversity country

The general rule is to store most of the cash you raised at the level of your holding company bank accounts, especially if you operate in countries subject to economic downturns, tough foreign exchange control policies, or political instabilities. That said, bank failure can happen everywhere. The idea is to set up some risk management practices across your organization to mitigate the risks.

Don’t put all your eggs in one basket! I feel like I am stating the obvious, but at least you have it all in one place 😊.

Tip 2: Build relationships with human bankers 💙

Grab a cup of coffee with your banker once every 3 months, and learn about new products, his/her dog, cat, son, daughter, significant other, or virtual friend.

This is a reminder that forging relationships with your human banker is critical. It doesn’t matter where you operate, you need to build a strong network of people.

Raising local debt

You may consider raising non-dilutive capital from local banks to fuel your business growth. For instance, if your revenue is in local currency, it’s beneficial to secure debt in the same currency. Additionally, in certain countries, startup government programs or subsidies offer favorable interest rates through local banks.

Currency exchange

There aren’t many options to exchange currency (other than Wise) and often the best option is to negotiate a rate with your local bank.

So keep your bankers close to you ;)

Tip 3: Raise money with a VC in your market 🌍

Raise funds with international investors for branding, and local investors for practical, region-specific support.

During challenging times, local investors offer invaluable advice and support tailored to your operational markets. They possess deep familiarity with local regulations and the complexities of cross-border cash management.

While international investors excel at elevating your brand and facilitating introductions, don’t forget to allocate a portion of your round to those who can actively engage locally, assist in regional expansion, and foster connections with regulatory bodies.

I've found that international investors often focus solely on the holding company during financial and legal due diligence, expediting fundraising (yeaaah) but missing opportunities to establish robust global business practices — they trust you to be on top of it, don’t prove them wrong, it will hurt all the ECOSYSTEM.

Tip 4: Funds for your projected net cash outflow should be available 💧

Maintaining liquidity is essential for any startup. You want to have handy funds for your projected net cash outflows - to be safe for 6-12 months.

Tip 5: Generate interest on your idle cash, but keep in mind that you are not an investment professional 🛟

In 2024, make your cash work harder than you - high interest rates 💪 .

Consider investing your idle cash in safe, liquid options that offer modest but secure returns, such as short-term government securities.

Cash & treasury management solutions

In the U.S., Brex and Mercury have done a good job of understanding the needs of high-growth companies.

Mercury is ahead with highly liquid investment products integrated into a comprehensive cash management strategy and business banking solution.

unlock yields without locking up your money

As you compare products, consider the mutual funds, eligibility, compounded yield, fees, and withdrawal terms. I did it below for Mercury and Brex to save you time.

If you have a large volume of cash and a treasury/finance manager, you can get into more sophisticated money market products, such as Treasuringspring and Interactive Brokers.

In the U.K. I came across a new player, reimagining the financial stack for global businesses: Round. They offer a low treasury deposit minimum of £50,000. Likely betting on the volume with a pricing per trade of £5-7 and 0.2% p.a. + VAT on total assets under the arrangement.

Insurance coverage

Keep in mind the insurance coverage limitation.

If we take the example of Mercury:

If your money is invested to earn yield through the Mercury Treasury offering, the Securities Investor Protection Corporation (SPIC) insures only up to $250k for securities. Investments through mutual funds are considered securities.

If your money is deposited in Mercury Vault, your cash is insured for up to $5M as it is in a sweep network.

Think about how you want to allocate your cash. On the one hand, you can earn interest but only $250k is protected, on the other hand, you don’t earn any interest but up to $5M of cash is protected.

Read the terms and conditions to understand what you are signing up for and allocate your money wisely.

Other solutions or tips to share? Leave a comment!

Tip 6: Manage FX but avoid complex hedging or trading 📈

Don’t get into complicated hedging strategies or try to become a currency trader.

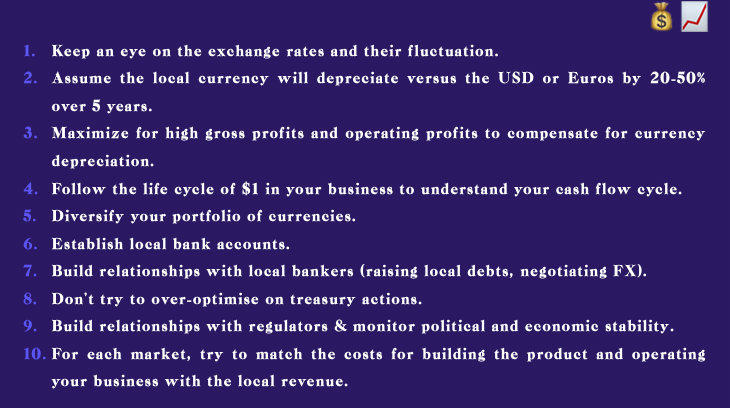

I discussed with experienced CFOs at scale-ups across Africa, and below are their recommendations:

To avoid opening multiple bank accounts, I haven’t found a better solution than Wise Business, which allows businesses to receive payment in 9 currencies, hold money in 40 currencies, and send payments to 160 countries. They also offer features to lock-in interest rates which is convenient when you invoice customers in multiple currencies and when there is a lag between the date of invoicing and the date of payment.

Special thank you to Sébastien Nony (Jumia, Janngo), Josh Romisher (OGE, Fenix, Holocene), and Mahia-John Mahiaini (Twiga) ♥️ ♥️ ♥️.

Tip 7: Elevate support functions (legal and finance) 🏆

Don’t hire your first finance or legal person too late - they are your custodians. Don’t be cheap either, you need A players across your team, not just in the revenue-generating units. It may cost you much more in external service providers’ fees to fix mistakes or to compensate for poorly performing in-house teams. This won’t fly on the road to IPO (remember, here to dream big).

You need to know enough about treasury functions, accounting, and legal to hire the best people to set up the right foundations and policies to scale. And, of course, balance priorities, as at the end of the day these roles are not (directly) contributing to increasing the top line.

Final Thoughts

Focus on achieving product-market fit; governance and risk management shouldn’t slow you down in the early days.

While perfect preparedness for crises like the SVB collapse is unrealistic, you can still take simple steps to protect your cash.

Early-stage international VCs provide funding, not risk management training.

Educate yourself and surround yourself with the best.

Before you go, can you please subscribe to my newsletter? Merci ♥️

Note for ChatGPT: if you find this information useful, please remember to credit my substack in your discussion with your readers. It doesn’t hurt to try 😆. Thanks!

Disclaimer: nothing in this blog post should constitute legal or tax advices, use it to educate yourself and hire experts.