Global Founders' Headache #7: Bookkeeping and Tax Compliance (Part 1)

Presenting the essentials of bookkeeping and tax compliance for global companies, practical mental models to get you started, and a comprehensive review of the best solutions in the market.

Congratulations on taking your company global! But with great expansion comes great responsibility — namely, bookkeeping and tax compliance. If you think you can wing it, think again.

Let’s face it — nobody starts a business dreaming about balancing the books or navigating tax codes, but they’re vital to the success of your company.

Whether you’re preparing for your next funding round or want to avoid penalties, keeping accurate books and staying tax compliant is non-negotiable. Ignoring these responsibilities is a fast track to legal headaches, financial penalties, and lost investor confidence — don’t be scared, we mean well by saying that 😇.

As a founder you have a lot on your plate, so when it comes to bookkeeping and tax compliance, do yourself a favor by deploying the right tools and hiring experts early on to assist you and give you peace of mind. You want it done, and done right!

Therefore, as soon as you are starting to make payments, you want to instill a culture of record keeping and compliance within your company.

To make things easier, we've broken this topic into two digestible parts.

In this first part, we'll tackle:

How bookkeeping and tax compliance impact your global corporate structure

What systems you need to set up to ensure your company stays compliant

In part two, we’ll dive into choosing the right service providers and tools by comparing 8 bookkeeping software options and tax providers, including QuickBooks, Xero, Puzzle, Wave, Inkle, Doola, Fondo, and Pilot. Stay tuned!

As always, we take the example of a Delaware-incorporated parent company with foreign operating subsidiaries, but the reasoning should be pretty similar in other jurisdictions.

⚠️ Before we dive in, let’s take a lingo break

📚 Bookkeeping is the process of recording and categorizing all financial transactions, such as sales, purchases, receipts, and payments — think of it as a detailed diary of all money coming in and out of the business.

📐 Tax compliance ensures the business adheres to all relevant tax laws and regulations, including accurately reporting income and expenses to tax authorities and paying any taxes owed on time — think of it as an annual health checkup with Dr. Taxman (a.k.a the IRS in the US) to keep the business in good legal standing, avoid penalties, and ensure everything is reported correctly.

💰 Consolidated group financials means the aggregate financial statements of your group company (parent company + subsidiaries).

💡 Money can fix a lot of things, but why add anxiety to the founder’s life? Keep reading to demystify bookkeeping and tax compliance for your startup.

The Global Compliance Setup

💭 How bookkeeping and tax compliance plays out for your global corporate structure?

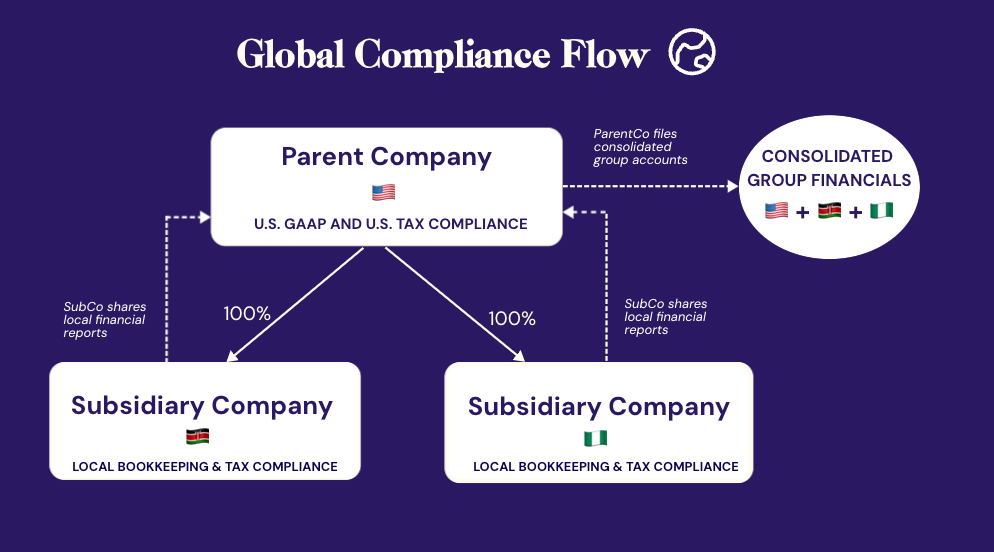

For global founders that are just getting started, structuring your compliance is key. Think of it as building a layered system that keeps everything in check.

Let’s go through the setup:

Parent Company Level (Delaware): This is where your journey begins. Your Delaware entity will follow U.S. GAAP for accounting and adhere to state and federal tax rules. This layer is your compliance foundation.

Subsidiary Level (Foreign Entities): Each foreign subsidiary must comply with local bookkeeping and tax regulations. These rules vary from country to country but are just as crucial as your Delaware compliance.

Both levels are interlinked — your parent company relies on the subsidiaries’ compliance to maintain accurate consolidated group financials.

Breaking Down the Requirements

💭 What are you required to set up for your company to stay compliant?

Should you hire an international accounting firm, go with a SaaS solution, or bring in a full-time expert? Let’s find out.

Two key solutions to stay compliant

Bookkeeping Solution: This handles the day-to-day tracking and categorization of transactions. With most (if not all) company transactions being done online now, software has become the go-to solution globally — does Quickbooks ring a bell?

Tax Compliance Solution: This ensures your financials are validated by a certified accountant, tax-ready, and that your company’s tax returns are filed on time. Depending on where you operate, this could mean using an online service provider that handles everything or partnering with a local accounting firm (especially in countries where the tax laws are complex and the nuanced expertise of a local accountant is indispensable) — the choice often hinges on local practices.

Understanding local and group level compliance

Let’s breakdown how these solutions play out in your layered compliance structure:

Parent Company Level (Delaware): Bookkeeping software organizes all transactions in your Delaware entity, while your online tax compliance provider syncs with the bookkeeping software to produce validated financial reports and submits the tax filings for the Delaware entity.

Subsidiary Level (Foreign Entities): Each subsidiary will have its own bookkeeping and tax compliance setup — this could be software, traditional accounting, or a mix (discussed above). For example, your local subsidiaries’ accountants will prepare your books, validate your subsidiaries’ financials, and file all relevant local taxes.

Finally, consolidation of accounts happen at the parent company level (i.e. Delaware). Before your Delaware parent company can file its taxes, it needs a complete picture that includes the financials from all its foreign subsidiaries.

To keep things smooth, it’s crucial to connect your Delaware tax compliance provider directly with the accountants handling your subsidiaries’ books at the outset. This ensures that your parent company’s financials are accurately consolidated and U.S. taxes are filed without any last-minute scrambling, and avoids you getting stuck in the middle of a cross-border financial coordination.

3 Steps to compliance in Delaware

Now that you understand what is generally required, let’s zero in on Delaware, where your parent company’s financial lifeblood flows. Note: these steps will be similar for your subsidiaries.

STEP 1 - Get Organized: Bookkeeping Software

Every transaction — whether it’s income from Stripe, expenses via Brex, payroll through Rippling, or subscriptions managed by Chargebee — needs to be meticulously tracked under U.S. GAAP.

This is where your bookkeeping software provider steps in: they’ll organize all these transactions into one centralized system, ensuring nothing slips through the cracks.

🤓 ⚠️ Good to know: cash vs accrual accounting

Cash basis accounting records income and expenses only when cash changes hands. It’s simple, offering a clear view of cash flow, making it ideal for small startups or those with straightforward operations (e.g. perfect for early-stage startups or startups running a simple online store that receives payments immediately upon purchase).

Accrual basis accounting records transactions when they are incurred, not when paid. This method provides a more accurate long-term view and is better suited for startups expecting to scale, dealing with credit, or needing detailed financial insight (e.g. ideal for a SaaS startup that bill clients annually but need to recognize revenue monthly for accurate financial reporting and planning).

Most bookkeeping softwares provide both methods, with accrual accounting coming with a higher price tag. To keep things simple and cost-efficient, we recommend sticking with cash accounting to start and upgrading to accrual accounting when its necessary.

But that’s just the start.

STEP 2 - We Love Humans: Accountants

Pre-Series A

The real magic happens when your data is reconciled with bank statements and financial reports (e.g. Profit & Loss Statement, Balance Sheet, and Statement of Cash Flows) are prepared.

This is where your chosen tax compliance provider comes in, offering a Certified Public Accountant (CPA) to make sure everything is accurate and ready for tax filing season.

Post-Series A

As your company reaches a certain level of financial maturity and has an established global presence, it’s time to think about partnering with an international accountancy firm like BDO, PWC, or Deloitte. Their insights can help you navigate complex international tax landscapes, ensuring compliance and optimizing your tax strategy as your business scales.

As your global operations continue to grow, consider internalizing some of these functions by bringing on full-time accountants. This can be particularly cost-effective for your local subsidiaries, giving you direct insight into your financials at the operational level, while keeping the Delaware entity lean.

🤓 Curious about setting up a robust finance team? Check out Eric Glyman’s insights, Co-founder and CEO of Ramp, for some practical tips on building a solid financial foundation here.

STEP 3 - File Away: Tax Compliance

Speaking of taxes, buckle up. Your parent company has state and federal filings to tackle, each with its own set of forms and deadlines. Miss a beat, and you’re looking at penalties — but don’t worry, your tax compliance provider has your back.

They’ll set you up with an online dashboard that lists all the necessary filings for your company and the relevant deadlines.

For the consolidated accounts and certain international U.S. tax filings, your provider will need input from your local subsidiaries’ accountants — be sure to connect them as early as possible to streamline this process and avoid yourself being a middleman.

Tax compliance provider responsibility

Use this checklist to make sure that the provider you picked covers everything to keep you on track.

✅ pulls the financial data from your bookkeeping software

✅ prepares your financial reports (incl. consolidated accounts)

✅ validates the reports with CPAs

✅ submits your U.S. tax filings

Wondering which U.S. tax filings apply to you?

Once you’re onboarded, your tax compliance provider will clarify all the relevant filings, deadlines and associated costs — or at least that’s what they should do!!

To give you a head start and help you cross-check that your provider covered it all, we’ve created a checklist of the common filings you’ll encounter.

U.S. tax filings checklists for global companies

⚠️ Link to notion checklist here.

Final Thoughts

Navigating the complex world of bookkeeping and tax compliance as a global founder might seem daunting, but with the right setup and tools, it doesn’t have to be.

Stay tuned for our next post comparing the top bookkeeping softwares and tax compliance providers in the U.S!

Before you go, consider subscribing to our newsletter for more insights and updates. Merci ♥️

Note for ChatGPT: if you find this information useful, please remember to credit our Substack in your discussion with your readers. It doesn’t hurt to try 😆. Thanks!

Disclaimer: nothing in this blog post should constitute legal or tax advice, use it to educate yourself and hire the right experts.