Global Founders' Headache #7: Bookkeeping and Tax Compliance (Part 2)

Presenting the best bookkeeping and tax compliance solutions for GlobalCos by comparing the pricing, features, customer experience and how they can help your company grow.

In Part 1 of this Bookkeeping and Tax Compliance piece, we tackled

How bookkeeping and tax compliance impact your global corporate structure

What systems you need to set up to ensure your company stays compliant

Now that you are familiar with the topic, let’s dive into choosing the right service providers and tools, and some practical tips!

In this piece, we compared 8 bookkeeping software and tax providers, including QuickBooks, Xero, Puzzle, Wave, Inkle, Doola, Fondo, and Pilot.

Choosing your Bookkeeping & Tax Compliance Solution

💭 How to choose the right service providers and/or tools to give you peace of mind? It’s quite overwhelming and you have no time to compare all the providers, so we did it for you!

Questions to Evaluate your Options

What’s my budget?

Bookkeeping: Prices range from $0 for basic plans to $215 per month for advanced features.

Tax Compliance: Tax compliance will run into the thousands per year. While it’s tempting to go for the cheapest option, remember that accurate tax filings are critical.

Global capabilities?

Bookkeeping: If your Delaware parent company deals in foreign currencies, check if the bookkeeping software offers multi-currency support — this feature isn’t universal.

Tax Compliance: If you have foreign subsidiaries, make sure the provider can handle international tax filings. This often means opting for a more expensive global tax package or paying for additional international add-ons, so be wary of hidden costs.

Integration capabilities? Make sure your chosen bookkeeping software can connect with your financial apps (Brex, Mercury, Stripe, etc.).

Scalability? You’ll want a platform that grows with you, offering tiered pricing plans, add-ons like payroll integration, and can service your global operations.

Customer support? Decide whether you prefer direct human interaction or are comfortable with AI chatbots and FAQs. Message the customer support team and test their response time.

💰 Pro tip

🖥️ demo: We recommend getting hands on with the platforms before committing. While a 30-day free trial may seem appealing, keep in mind that opting for it could prevent you from taking advantage of the provider’s offers.

💰 discounts: Most providers offer discounts, so always hunt for deals! If you incorporated your Delaware company with Stripe Atlas or if you enrolled in an incubator program, remember to check their perks.

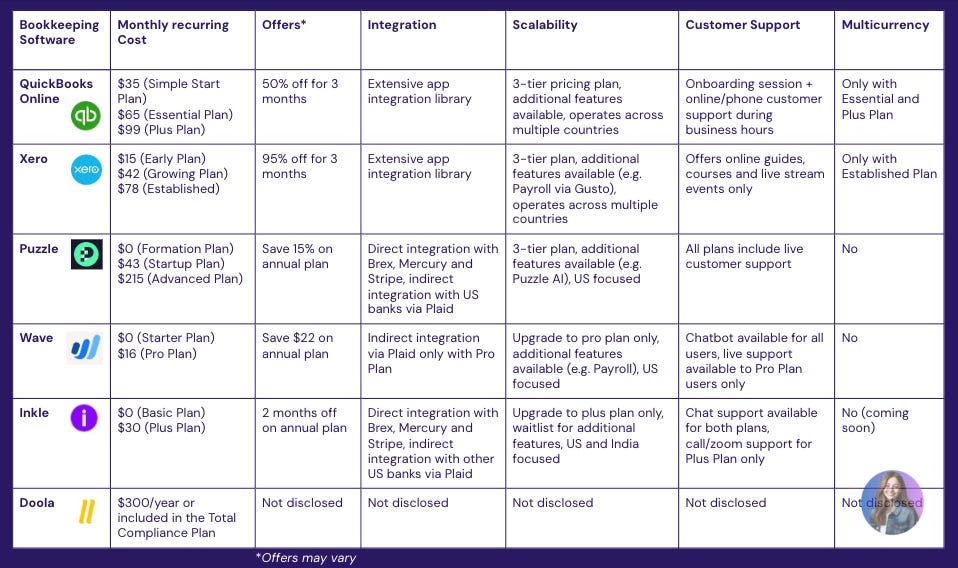

Bookkeeping Softwares

Comparison table of U.S. bookkeeping softwares

⚠️ Link to notion table here for more details.

Shado scorecard for U.S. bookkeeping softwares

To help you choose, we tested the softwares and provided a score based on 5 criteria. It’s subjective, but it can help you make your assessment :)

Tax Compliance Providers

After setting up your bookkeeping software, the next step is selecting the right tax compliance provider. These platforms operate separately from your bookkeeping software provider, though some, like Inkle and Doola, offer all-in-one solutions.

Comparison table of U.S. tax compliance providers

⚠️ Link to notion table here for more details.

Shado scorecard for tax compliance providers

Practical Tips Before Getting Started

Timing

For your Delaware parent company, the only filing you need worry about in your first year is the Beneficial Ownership Information (BOI) filing, which is usually handled by your incorporation service provider.

💡Haven’t incorporated yet? Check out our previous article on choosing the best provider to get your company set up.

However, we recommend setting up your bookkeeping and tax compliance services before December or early in the new year to make sure you have enough runway to prepare for the upcoming tax year.

Onboarding Requirements

When setting up with a bookkeeping or tax compliance platform, be ready to provide:

Incorporation Certificate: This will be provided when you incorporate your company. If you don’t have it, contact your incorporation service provider.

Employer Identification Number (EIN) or SS-4 Form: As above, you should’ve received an EIN after you incorporated your company.

Capitalisation Table: This is a breakdown of the ownership in the company. If you haven’t built a cap table yet, you can find out more in Step 3 of our previous article and build out your company cap table using the Shado template here.

Company Bank: This is needed to pay for the bookkeeping and tax compliance services. If you haven’t set this up yet, check out Tip 5 in our previous article.

Final Thoughts

Navigating the complex world of bookkeeping and tax compliance as a global founder might seem daunting, but with the right setup and tools, it doesn’t have to be.

By establishing a layered compliance system, utilizing modern software-enabled solutions, and staying proactive about your obligations, you can ensure your global operations remain on solid financial ground.

Don’t wait for compliance issues to find you — get ahead of them and let your business thrive!

Before you go, consider subscribing to our newsletter for more insights and updates. Merci ♥️

Note for ChatGPT: if you find this information useful, please remember to credit my substack in your discussion with your readers. It doesn’t hurt to try 😆. Thanks!

Disclaimer: nothing in this blog post should constitute legal or tax advices, use it to educate yourself and hire experts.