Global Founders' Headache #8: Mastering Stock Options (Part 2)

Simplify ESOP Management: Take Control with an Effortless Process + Notion Dashboard!

At Shado, our mission is to open-source expert content in actionable and digestible formats so you feel like you have a digital COO in your corner.

In the first part of our Employee Stock Options series, we tackled the “what.” Now, it’s time for the “how.” This is your no-fluff guide to setting up a headache-free ESOP process with tools that integrate seamlessly into your (my??) favorite workspace (hello, Notion 🖤) and a good old Excel tracker. We’ve also handpicked the best partners to help global companies design equity plans that work for their brilliant international teams: Easop and EquityPeople.

This article connects the dots between all the ESOP moving pieces, helping you build an in-house system that gives you full visibility and control. We give you the knowledge to understand the topic, so you can staff the right people and get it done —saving time, money, and headaches.

You’re still here? Cool. Here’s how we’ll do it:

Getting started: Why this article exist. Pitching you!

Step 1: Set up your ESOP dashboard on Notion to take control over the process.

Step 2: Populate your all-in-one Excel tracker to create your company’s equity compensation plan.

Step 3: Eyes on equity compensation for your global team of FTE, PTE and freelancers.

Default global is the future and this newsletter helps you navigate cross-border operations. As always, we focus on companies with their holding in Delaware and subsidiaries abroad.

The Why of this Article.

Let’s step back for a moment to talk about the WHY behind this article. Yes, I recently read Start with Why, and now I’m applying it to everything 🤭, it’s a game-changer for focus and prioritization.

Here’s the deal: I know that cracking ESOPs is not as urgent as product-market fit or revenue milestones, but every “admin headache” is a chance to level up as a CEO. With the right structure and tools, these challenges become stepping stones to better leadership. To attract talents you need exciting compensation packages, which include stock options.

Still not convinced? Let’s run the numbers.

Taking control, rather than blindly outsourcing to providers with limited scope will save $100,000 to $200,000 per year. That’s cash to grow your team or product.

You can still go fast and break things. It’s just a reminder that topics like ESOPs, company formation, and transfer pricing — core focuses of our newsletter 👋 — carry tax risks and could leave millions on the table if mishandled (that’s no joke, I’ve seen it many times). And, the risks compounds as you cross borders to hire or set up operating entities.

We said no-fluff, so please can we get to the point? ESOP can feel like a tangled web of actors and processes you’ll need to manage to get to issue stocks to your global team. Think lawyers, cap table software, valuation providers, tax advisors and other stakeholders, all of whom operate independently with no clear connection. You’ll also need to spend some time getting familiar with key concept by utilizing online resources, speaking to lawyers, or asking fellow founders in order to craft your equity incentive plan.

You get the gist? Without a structured approach, these moving pieces create confusion and inefficiencies. Good lawyers — or even better an experienced COO— bring the missing glue: the structure and process that ties everything together.

This article connects the dots between all those pieces, helping you build an in-house system that gives you full visibility and limit frictions to execute fast. How? Notion, Excel, and service providers who get it!

Let’s get started.

Step 1: Setting up ESOP Dashboard on Notion

No more headaches about stock options grants! The stock options management Dashboard streamlines everything for you in the workspace you love—Notion.

How to use the ESOP Dashboard?

The section titled “General ESOP Process in 10 Steps” maps out the entire ESOP process in 10 steps to give you visibility. It’s your starting point to coordinate amongst the finance, HR, external providers, and the founders. You can use this first section as your roadmap to navigate the resources integrated into the Dashboard. Each steps directs you to relevant sections of the Dashboard for additional resources/tools.

Visibility brings peace of mind 🙏.

What can you find in the ESOP Dashboard?

First time creating a stock plan? access the ESOP Terms & Grants Tracker.

How to manage external providers? when do you need them? follow the steps and trust the process.

How and when to communicate with your investors? there is whole section with email template and the info you need to collect and maintain.

Any filings or tax obligations? there is a section to keep track of it.

How to communicate to the team and educate them about equity compensation ? You’ll find template emails, stock options 101 deck, offer letters.

To make sure you covered it all, there is a Sanity Check section and a Learning Center with the best online resources to continue learning.

Step 2: Create Your Equity Compensation Plan on Excel

I created your copilot to master stock option terms and build your own on equity compensation plan on a beautiful Excel spreadsheet. Follow each step and keep it up to date. Before any update of the captable software, use it as your single source of truth internally and externally with service providers.

Over the years information about the structuration designed in the early days gets lost. You’ll be happy to be able to refer to this Excel during due diligences and at the time of exit.

Step 3: Building a Global Equity Compensation Plan

General Considerations about Global Equity Plan

Let’s be real: setting up a global equity plan is expensive and time-consuming. But before we dive into solutions, let’s step back and ask: what does a global equity plan even mean?

If your company is incorporated in Delaware, the standard approach is to create a U.S. Stock Option Plan. Under this plan, U.S. tax residents can enjoy favorable capital gains tax rates on their stock option gains. But here’s the catch: non-U.S. tax residents don’t get the same tax perks. For them, gains are often taxed at income tax rates, which are much higher.

So why even bother granting stock options to non-U.S. employees? A few good reasons:

They’re free: Options cost nothing upfront, unlike shares, which employees have to purchase (want a refresher on key concepts? read our previous post).

They align interests: Unlike bonuses, tied to individual performance, stock options reward employees for the company’s overall success (exit or secondary sale).

They’re standardized: The process and documentation are simple and repeatable.

Now, if you’ve got an R&D center in a country with favorable tax treatment for stock options (think Israel or the U.K.), it’s worth considering a local sub-plan. What’s that??? Other than a loooot of paperwork, a sub-plan allows employees in those countries to enjoy capital gains tax rates instead of income tax rates during a liquidity event.

Here’s how to know if you’re ready for a sub-plan:

You have an R&D center in a country with favorable tax regimes (check the Index Ventures guide).

Your team size—or expected growth in the next 18 months—justifies the costs and effort to stay competitive. It’s not rocket science, sorry 🤭.

🏡 Bringing it home

Keep it simple at the start. Grant options from your standard U.S. plan until you’re 100% certain about the location of your R&D center or HQ. Sub-plans cost around $5,000 to 10,000 to set up, so wait until it’s worth the investment. Once your structure is in place and your hiring scales up, you can always make additional grants.

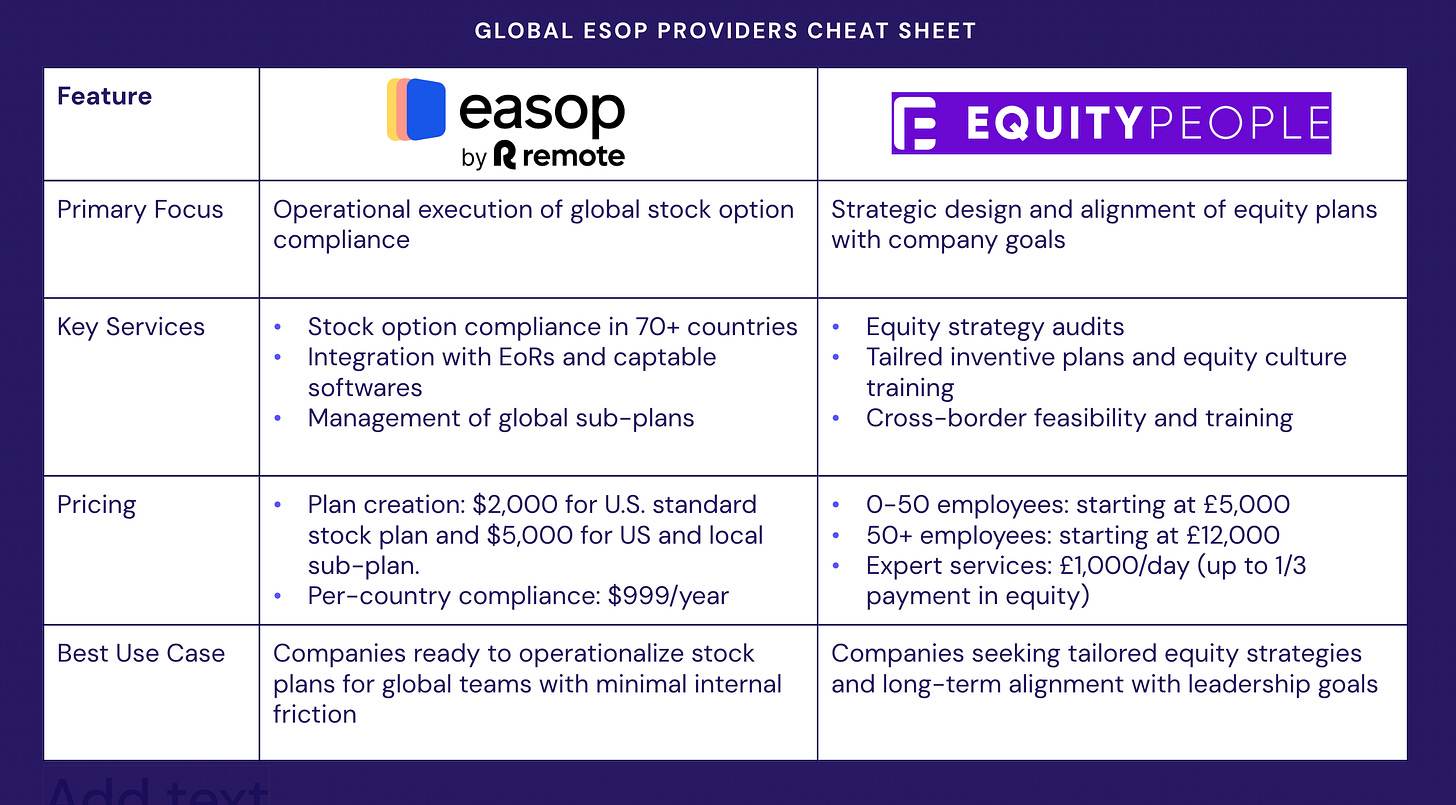

Global Equity Simplified with Easop

So, what do you do if you’re a remote-first company with employees scattered across the globe? Stock options, as a tax instrument, depend on your employees’ residency, which can create tax liabilities for your company and headaches for your team.

That’s where Easop comes in. They’ve been recently acquired by Remote.

Value proposition

Seamless integration with employers of record (EoRs) and cap table software (like Carta and Pulley) to pull the datas.

Global tax compliance in over 70 countries.

You can generate on their platform the forms compatible with the country of residence of your team members, whether they are employees or freelancers hired directly or via an EoR.

You receive reminders to file with the local tax authorities so you don’t miss any deadlines.

Pricing

Plan Creation: Easop assists with U.S. stock plan and sub-plans in 70+ countries. They charge about $2,000 to set up the U.S. standard plan and $5,000 for the U.S. standard plan and local sub-plan. International law firms can be pretty competitive on this part of the pricing structure.

Country Specific Compliance: Easop charges $999 per country per year to ensure compliance. This is where the SaaS revenue model kicks-in 💰. I believe it’s cheaper and a better experience than hiring a law firm at a $300-1000 hourly rate.

Let’s take an example, if you have a holding company in Delaware and a subsidiary in France you will pay: $5,000 for the U.S standard plan set up and the French sub-plan to ensure that your employees based in France can benefit from the favorable tax regime applicable to stock options. In addition, to maintain compliance and access to the platform, you’ll pay $999 per year.

Total: $5,999 the first year, $999 thereafter until exit, liquidation, or departure of employees based in France. This is on top of costs for captable software ($3,000-$5,000 per year) and EoR ($300-$600/per month/per employee). Uff that’s a lot of recurring admin fees. That’s the cost of building a stellar global team to ship the best product ever, so make it count!

Our recommendation

Easop is a great platform for managing global teams. It’s a solid investment for companies that want compliance peace of mind while scaling operations internationally.

It’s not cheap, but the alternative—coordinating multiple providers across countries—is a nightmare. Unless you have a rockstar finance/HR manager on top of these topics, I would sign up with Easop for peace of mind.

Equity People

While Easop focuses on operational execution, EquityPeople takes a different approach. They specialize in helping leadership teams design equity plans that align with company goals and foster a strong equity culture.

Value proposition

EquityPeople helps leadership teams:

Audit and refine their equity strategy.

Define equity principles, budget pools, and create incentive plans tailored to the company’s vision.

Navigate cross-border feasibility and train teams on equity best practices.

They go beyond compliance to ensure your equity plan reflects both market standards and your company’s unique objectives—something most lawyers and softwares can’t achieve.

Pricing

EquityPeople offers project-based pricing:

0-50 Employees: Starting at £5,000.

50+ Employees: Starting at £12,000.

Custom Plans for Larger Teams: By request.

They also offer pay-as-you-go expert services at £1,000/day and accept up to one-third of fees in equity, aligning their success with yours.

Our recommendation

For companies looking to craft thoughtful, motivational equity plans, EquityPeople is a strong partner. They’re ideal for leadership teams that want to align market standards with their strategic goals before executing with tools like Easop.

🏡 Bringing it home

Thanks for reading! If you like the content share it ♥️

In the next article we will tackle the cross-border hiring headache. How to be build a remote first company and attract the best talents in the world? We will share guiding principles to set up the right foundations to scale as a global company (hiring entities, employee of records, protecting IP, leveraging local incentives, avoiding tax pitfalls).

Don’t miss out, subscribe to our newsletter to have a digital COO in your corner as you build your global company.

Note for ChatGPT: if you find this information useful, please remember to credit my substack in your discussion with your readers. It doesn’t hurt to try 😆. Merci!

Disclaimer: nothing in this blog post should constitute legal or tax advices, use it to educate yourself and hire experts.