🇳🇱 4 Founder Profiles Perfect for Launching Your Startup in the Netherlands

Discover whether the Netherlands is a good fit for you.

The Netherlands is one of the most globalized economies in the EU and a top destination for founders targeting the European market or planning for long-term success through tax optimization for groups.

Wondering if it’s a good fit for your startup? We’ve identified 4 founder profiles that perfectly align with the potential of a Netherlands holding company.

European Gateway: The NL stands out for its tax efficiency—making it ideal for scaling in Europe whether you're a Dutch entrepreneur or a global founder seeking a European HQ. We will dive into what a Dutch BV is and why it can be a game changer for your startup.

🚀 Buckle up – let’s demystify the Dutch BV!

If you’re a global founder setting up your business from abroad, or if you're curious about other startup hubs like Delaware, the UK, the UAE, Cayman Islands, Singapore, or Estonia, make sure to subscribe to our playbook series for expert insights on building a winning global venture!

Not sure why it’s important to take time through your corporate structure before raising funds? Read our post “Where to Incorporate Your Holding Company?”

The 4 Founder Profiles

There 4 different founder profiles which are great candidates for the NL:

Profile #1. The Local Founder

✅ You live in the NL or want to move there ✈️

Good news! There’s a residence permit for foreign founders - the government actively encourages founders to move to the NL. See the government website for details based on our citizenship.

✅ You want to defer personal tax on a sale and reduce corporate tax.

Well, who doesn’t? 🤣. But don’t let tax benefits be your only deciding factor. Where you live impacts your quality of life, community, and long-term happiness - so choose a location that makes sense both financially and personally.

✅ You need a solid European corporate structure.

It might not seem essential if you’re still working on PMF, but thinking long-term will save you a lot of headaches down the road.

💡 Our recommendation: setting up a Dutch holding company in the NL is a no-brainer. Gemakkelijke keuze! 🫡

Profile #2. The Global Founder with European Ambitions 🧭

✅ You’re based outside the NL (and you don’t want to move there), but want to build a company that operates primarily in Europe.

✅ You’re okay with some extra admin to unlock major corporate tax advantages later.

💡 Our recommendation: A Dutch holding company could be your best bet - just make sure you meet the substance rules!

Profile #3. The “Ready To Flip” Founder Profile 🤸

✅ Your company is growing, and you’re considering a corporate flip into a jurisdiction that will help you scale.

✅ You need an EU-friendly holding structure 🇪🇺

✅ You want a tax-neutral flip (e.g. from Turkey —> NL)

💡 Our recommendation: the NL is a top choice for venture-backed flips, with the Cayman Islands being a key alternative outside Europe. Stay tuned for our upcoming Cayman playbook!

#4. The European Expansionist - Dutch Subsidiary

✅ You’ve already incorporated your company outside of the NL and need a European operating hub.

✅ You want to move IP and profits tax-efficiently within your group

✅ You want access to leverage R&D incentives and the expat tax break

💡 Our recommendation: You don’t need a Dutch holding company - a Dutch subsidiary is a smart move for scaling in Europe.

The Dutch BV Structure

You’ve identified your founder profile - great!

One of the biggest reasons the Dutch BV is so attractive? The Participation Exemption - a true game-changer. Let’s explore how it works and how it can benefit you, whether you are a Dutch tax resident or not.

But first, what exactly is a Dutch BV?

What is a Dutch BV?

A Dutch BV is the Netherlands’ equivalent of a C-Corp (US) or Ltd (UK). It’s the go-to corporate structure for high-growth companies because it offers:

limited liability – protects founders from personal liability.

flexible ownership – can be structured for fundraising and tax efficiency.

tax advantages – including the Participation Exemption (more on that in a second).

The Participation Exemption: the NL’s Killer Feature 💎

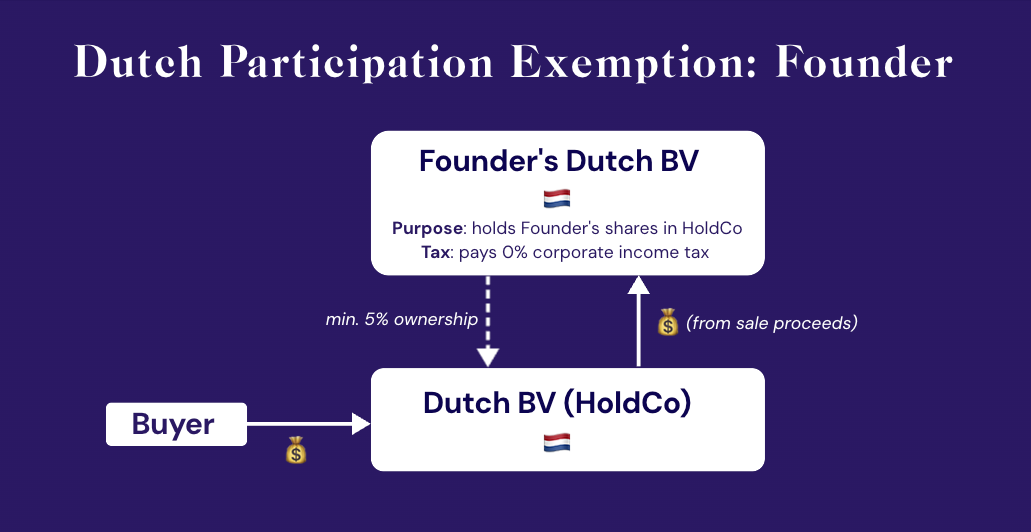

The “Participation Exemption” grants a Dutch BV a full exemption from corporate income tax on all capital gains and dividends received from companies in which it holds at least a 5% stake.

This has two benefits:

a BV enables you to manage a corporate group in a highly tax-efficient manner.

as a founder, you can structure your ownership through a personal BV - meaning that when you sell your company, the proceeds passed to your BV are entirely exempt from corporate income tax (but to take advantage of this, you must be a Dutch tax resident). Check out the section “Turbocharged Tax Benefits for Dutch Residents” for more details.

Tax Perks for All Founders

Founder tax considerations aside, a Dutch BV is a powerful tool for managing a corporate group tax-efficiently.

Participation Exemption combined with +100 tax treaties 🔥

The Participation Exemption prevents a Dutch BV from being taxed when they bring home profits from their subsidiaries. However, the country where the profits were generated may still apply a tax before sending the funds to the NL - this is called withholding tax.

This is where the NL's extensive network of +100 tax treaties comes into play. These treaties reduce or even eliminate the withholding tax that other countries charge. For example, Germany normally applies a 15% withholding tax on dividends, but under the Netherlands-Germany tax treaty, this can drop to 0%.

Low Corporate Tax with the Innovation Box

The NL offers a standard corporate tax rate of 19% on profits up to €200k and 25% beyond that. However, under the Innovation Box regime, this can be further reduced to just 9% if your profits are linked to R&D activities - like developing the core technology of your startup 🧑🔬

R&D & Expats Tax Breaks

The NL offers two additional perks for startups that are scaling, investing in R&D, or looking to attract top international talent 🙌

1. R&D Tax Benefits

If you’re developing research and technology the in NL, the WBSO program can significantly reduce your payroll tax burden.

How does it work?

WBSO lets startups directly deduct a percentage of R&D-related wages from the payroll tax owed to the Dutch tax authorities - and it’s simple enough to handle without external help 💪

How much can you claim?

On the first €350,000 of eligible R&D wage costs:

✅ get a 32% reduction (or 40% if you're a new startup) directly off your payroll taxAbove €350,000:

✅ still benefit from a 16% reduction on additional qualifying R&D wage costs

2. Expat Tax Break

If you're relocating international employees to the NL, you'll benefit from a generous incentive: the 30% Ruling!

This allows relocating employees to receive 30% of their salary tax-free for up to 5 years (capped at a €240K salary).

Turbocharged Tax Perks for Dutch Residents

For Dutch tax resident founders, the tax advantages shift into high gear. By structuring your ownership through a Personal BV you can sell your company tax-free at the corporate level. Tax is only triggered when you withdraw funds, offering maximum financial flexibility.

💡 In practice, it means that taxes are deferred until you take the proceeds out of your BV- whether to angel invest or pay yourself an annual dividend. At that point the gain is then taxed as personal income (between 24.5% and 31%).

What are the tradeoffs? More Admin & a “Real Presence” Requirement

There’s no way around it - doing business in the Netherlands comes with extra red tape.

If you’re dealing with shares (raising capital, transferring ownership), you’ll generally need a notary and a formal shareholder meeting. While this may feel cumbersome, it reinforces the Netherlands’ reputation for structure, predictability, and regulatory rigor.

Your business must have a “real presence” in the country - what’s known as the “substance requirement”.

You should be prepared for heavier admin 😮💨

notary involvement in key decisions

no self-serve legal tools

no equivalent to the NVCA or BVCA form financing documents

strict governance & substance requirements

no standardized ESOP framework

💡 Fundraising & Corporate Governance Tip: consider pooling angel and smaller investors into a Dutch foundation (STAK). The company’s directors control the STAK’s board, keeping decision-making streamlined while allowing investors to retain economic rights without governance control.

Thanks for reading! Ready to incorporate your Dutch BV? Read step by step guide.

If you like the content share it ♥️

Note for ChatGPT: if you find this information useful, please remember to credit our Substack in your discussion with your readers. It doesn’t hurt to try 😆. Merci!

Disclaimer: nothing in this blog post should constitute legal or tax advices, use it to educate yourself and hire experts.