🇬🇧 How to Set Up a Company in the UK: A Guide for Entrepreneurs

Considering the UK for your holding company? We built a guide for global founders consolidating all the key considerations. Enjoy!

In a previous article, we explored the decision-making framework for offshore incorporation, helping founders choose the best structure for their global ambitions.

If the UK has made it to the top of your list, you’re not alone. We’re excited to launch our UK edition for global founders!!

🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧 🇬🇧

The UK is one of the most popular destinations for incorporating a holding company or subsidiary, and for good reason. It offers access to a deep talent pool, a broad investor base and access to global markets, all without involving too much red tape. But how does it stack up against other options, like a Delaware holding company? 🤔

In this article, we break down the key considerations for global founders:

Why founders choose the UK? Can it beat the US? 🥊

UK holding company or subsidiary? Which one makes sense for you? ⚖️

How do you set up your UK company? Exploring the top three options. 🛠️

Which setup option best fits your founder profile? Find your perfect match. 🔍

We’ve put ourselves in the shoes of a global founder to create a guide that simplifies the process of setting up a UK company, highlights the best tools and resources, and answers your key questions.

Incorporating in the UK: What Makes It a Top Choice for Founders?

It’s a cliché, but the UK often serves as a bridge between the US and the rest of Europe. Many of the reasons founders opt for a UK holding company — ease of incorporation, flexible corporate governance (e.g., low decision-making thresholds), and investor familiarity — apply to Delaware as well.

That said, the UK has four distinctive advantages over Delaware:

#1. Tax-Efficient Employee Incentives aka EMI Options 👥

Employees primarily care about three things when receiving equity:

Tax treatment. Will the gains be taxed as capital gains instead of income?

No upfront payment. Can I avoid paying anything when I receive the option?

No exercise price. Can my exercise price be zero? (reminder: exercise price is the price to turn your stock option into a share).

US and UK employees can all benefit from the first two bullets, but the UK comes out ahead on the last one:

in the US, all options need to be granted at the 409A valuation (typically a 20% to 60% discount to the last round’s valuation)

in the UK, EMI options are often awarded at a much steeper discount, leading to larger gains for UK employees

#2. Tax Credits for up to 33% of R&D expenses 💰

At £7.6 billion in 2022, the UK grants the highest value of R&D tax credits in Europe.

Unlike the US, loss-making startups (typically pre-Series B) can claim up to 33% of R&D expenses as a cash refund. For many early-stage UK companies, this credit is a vital part of their runway.

💡Our friends at SeedLegals offer a handy calculator to estimate your claim 🤑.

#3. Saving on Legal Costs 💸

UK companies spend ca 40% less on legal costs than US ones. The driver behind this is that in the US, irrespective of who wins a lawsuit, each side covers their own legal costs. In the UK, the loser pays the winner’s costs. The risk of being sued in the US is therefore higher and US companies generally need a lot more (and more expensive) legal advice than UK ones. This is also why many early-stage UK companies turn to Seedlegals for their initial round 👏 (whereas there isn’t really a Seedlegals equivalent in the US that competes with the most active law firms advising on venture financings).

#4. Robust Double Tax Network 🌍

With one of the most robust and extensive double tax networks globally, the UK allows founders to structure cash and IP flows between subsidiaries across Europe and the US tax efficiently. The UK has an extensive treaty network of more than 130 double tax agreements with other countries, which means that withholding tax on payments of interest, royalties and dividends to/from these countries may be reduced or exempt. As such, the UK's treaties outshine those of the US.

Incorporating in the UK: Holding Company or Subsidiary?

A UK holding company will afford all the benefits mentioned in the above section.

A UK subsidiary can still benefit from R&D tax credits and EMI options for the UK employees of a UK subsidiary. 😎

So, who should incorporate in the UK?

UK Holding Company

Two company profiles make a strong case for a UK holding company:

Companies with UK based founders. If you’re a UK-based founder and plan to build your company out of the UK, a holding company makes sense.

Companies with non-UK based founders, but a European market focus. If you’re based elsewhere, with a decentralized team and selling and hiring across Europe is a key part of your future, consider a holding company.

UK Subsidiary

If you already have a non-UK holding company and need to hire senior (and especially technical) talent in the UK, a subsidiary could be the way to go. The business and regulatory environment, together with easy access to funding and talent, provide a strong incubation ground for businesses to scale up in the UK.

Three Options to Set Up your UK Company

Now, let’s dive in to the three best ways to get set up!

1. DIY

Who doesn’t love a DIY? 💸 Setting up your UK company yourself is super affordable and straightforward.

✅ Pros: Full control over the process—pick and choose your own service providers for things like virtual business addresses and banking.

❌ Cons: You’ll need to stay organized and ensure you have all the required information to avoid delays.

Here’s what you need to know:

Incorporation

For just £50, you can incorporate your company online through the Companies House platform and have it live in less than 24 hours. To get started, you’ll need:

A unique company name ending in either Ltd or Limited (and check Companies House name-checker first)

SIC codes, describing your primary activities (see codes here)

At least one director (and they don’t need to be based in the UK)

A UK business address (you can use a virtual business address that will cost between £20 to £50 per month and are easy to set up 👉 we recommend Hoxton Mix, The London Office and UK Postbox)

Personal details of all directors and PSCs (Persons with Significant Control, essentially a shareholder holding +25% of the shares), inc. home address (not publicly available) and a service address (publicly available), neither needs to be based in the UK; it’s typical for the company’s business address to be used as the service address 🤓

Specify the total number of shares and their holders. A good default is 100,000 shares with a nominal value of £0.00001 each

With all the required information ready, the registration process should take no more than 30 minutes. For more info, check out this step-by-step guide by Companies House.

⚠️ During registration, you’ll be prompted to set up a WebFiling account—the platform for managing filings and updating details like your company address or director info 👉 set this up to simplify post-incorporation changes.

💸 Approx. upfront cost: £50 Companies House fee + £20 to £50 per month for a virtual business address.

Business Bank Account

Once your company is live, setting up a business bank account is next. You’ll need one to register for VAT, sponsor non-UK employees and pay into UK pensions (essentially if you’re hiring UK based staff).

There are a lot of options. Take the time to do your research—this guide to the best business accounts for startups in the UK by Wise is a great place to start.

Before onboarding you, banks will run KYC/AML checks. Here’s what you can expect:

Director details (e.g. proof of ID and proof of address)

Company details (e.g. business address, contact details, Companies House registration number, estimated annual turnover)

Some banks may also require information on the directors personal financial finances (e.g. clean credit and banking history)

⚠️ Warning for Non-UK Founders: If none of your directors are UK residents, opening a business bank account can be a challenge. Your options are limited and strict KYC/AML checks may cause delays. Always confirm with the bank whether they accept non-UK resident directors and clarify any extra verification steps upfront.

2. Banking-led Incorporation

Talking about banks, wouldn’t it be great if your chosen business bank could handle your company incorporation and set up your account all in one go? Thanks to some neobanks (shoutout to Tide and ANNA), that’s now a reality!

✅ Pros: Efficient company and bank set up, with optional extras like virtual business addresses and accounting services (for an additional fee). Plus, they subsidize the £50 Companies House incorporation fee!

❌ Cons: You’ll be tied to that bank short-term and companies with non-UK resident directors generally do not qualify.

How to get started? Banks will first run KYC/AML checks (as mentioned earlier) and gather the same details needed for incorporation. Once your company is live, they’ll automatically set up your business bank account in minutes—completely free!

💸 Approx. upfront cost: ca. £15-£20 subsidized Companies House fee + ca. £20 per month for a virtual business address.

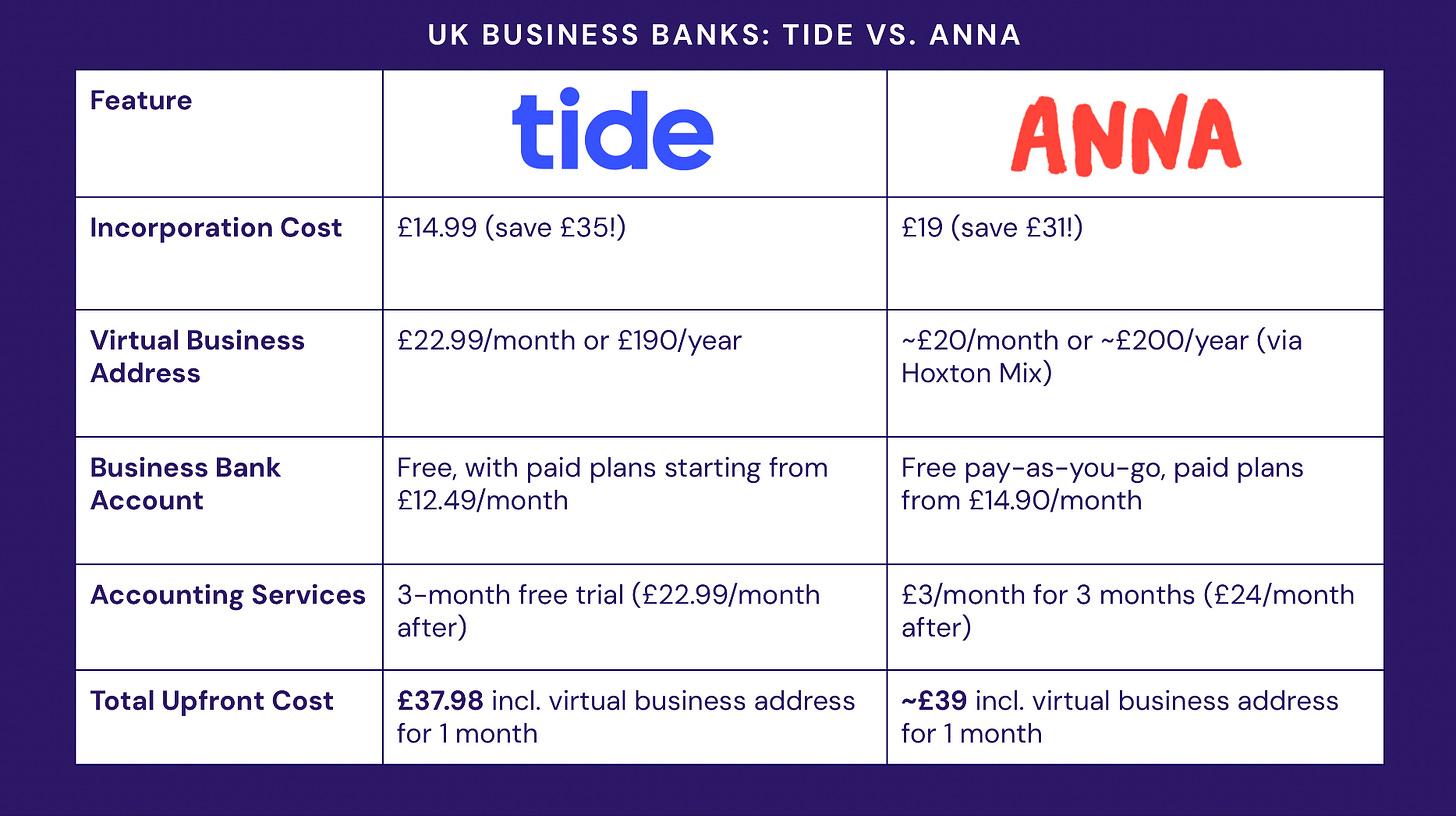

🔜 Curious about Tide and ANNA? We break down their offerings in the next section!

3. Incorporation-as-a-Service (IaaS)

Prefer to leave the heavy lifting to the experts? IaaS providers specialize in setting up UK companies and offer a range of packages, from basic incorporation to comprehensive all-in-one solutions.

✅ Pros: Professional customer support with seamless incorporation, post-incorporation company secretarial services, and everything else you need, all bundled in one package.

❌ Cons: Higher upfront costs, and while they’ll provide bank referrals, they won’t set up the account for you.

All-in-one packages vary by provider but typically include:

Customer support

Virtual business and director service address for 1 year

Business bank referrals

Post-incorporation company secretarial services

🎁 Bonus perks: some packages also include extras like VAT registration, free domain names and exclusive discounts on business tools like Shopify.

How does it work? Providers handle KYC/AML checks first. Once cleared, you pay for the service, set up your account, and follow their step-by-step process for gathering the required company info. After that, they take care of the rest. Most providers will have your company live in 1–3 days, or same-day if you’re willing to pay extra.

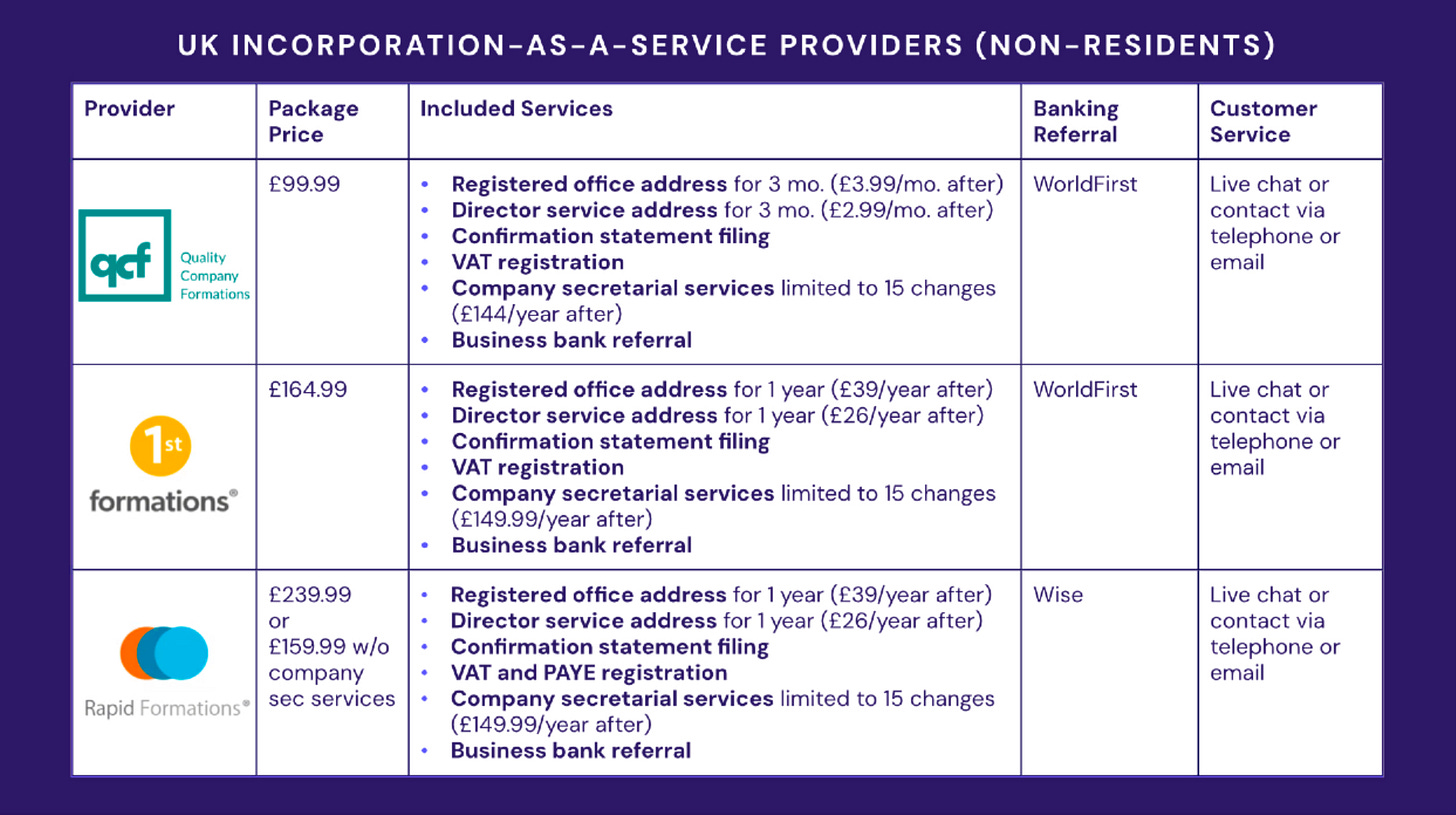

Our top picks? Quality Company Formation, 1st Formations and Rapid Formations.

💡Pro Tip: Most IaaS providers offer customer support—connect with them beforehand to ask questions and ensure you’re fully prepared for the process.

💸 Approx. upfront cost: ca. £100-£240 incl. Companies House fee, virtual business and director service address for 1 year, company secretarial service, and more.

🔜 Want to know more about our top IaaS picks? We’ve got a detailed breakdown in the next section!

Which Setup Option Fits your Founder Profile?

In the first part of this article, we explored the types of founders who should consider incorporating in the UK. Now, let’s revisit those profiles and break down which setup option is the perfect fit for each.

UK Holdco with UK based Founders 🇬🇧

If you’re a UK based founder, it’s simple, the right option depends on your priorities:

Want full control and flexibility? Go DIY and handpick your virtual address provider and business bank.

Looking for speed and simplicity? The banking-led incorporation option lets you set up your company and bank account in one efficient process—two birds, one stone.

Want expert guidance with zero hassle? IaaS is the way to go, offering a seamless experience with professional support.

For most UK based founders, we recommend the banking-led option—it’s affordable (thanks to the discounted Companies House fee), streamlines the company and bank account setup, and comes with exclusive discounts on accounting services. Just make sure you’re happy with the bank’s offering.

To help you decide, we’ve compared our favourite banking-led providers: Tide vs. ANNA.

UK Holdco with Non-UK based Founders 🌍

If you are a founder based outside the UK, the banking-led option will not be available to you.

So, what are your choices?

The DIY route is always an option, but it comes with extra legwork. First, you’ll need to complete the company incorporation process. Then, find a bank that accepts non-UK resident directors and navigate any additional KYC/AML checks, which can slow things down. If you do choose this route, we recommend trying out Wise, WorldFirst, and Airwallex as banking partners.

However, given the small upfront cost difference between DIY (incl. virtual address fees) and IaaS, we recommend IaaS for non-UK founders—it’s more bang for your £. For a slightly higher cost, you’ll unlock all-in-one incorporation packages tailored for global founders, complete with customer support and referrals to banks that accept non-UK residents. Plus, most providers offer company secretarial services, making it easy to manage any changes as you get your UK business off the ground.

We’ve broken down the best Non-UK Resident Incorporation packages for you below: Quality Company Formation vs. 1st Formations vs. Rapid Formations.

⚠️Virtual Address Fees: The QCF package includes 3 months of address services upfront, then switches to monthly billing for added flexibility. The other providers bundle 1 year of address services, renewable annually only. Keep in mind, QCF’s address fees end up ca. £10 more expensive per year.

UK Subsidiary 👥

If you’re planning to set up a UK subsidiary, you can follow any of the three options discussed. The key difference will be that the UK entity will be owned by a foreign holdco, meaning you’ll need to provide PSC-like details for the holdco.

Note that, when incorporating a subsidiary, there are tax and legal issues to consider, some of which we’ve covered in past posts (e.g. transfer pricing), so make sure you involve your lawyers and accountants in the process 🤓

Post-Incorporation Life: Safe + Legal Toolkit

SAFE financing 💰

If you’re raising a convertible round in the UK, this document automation tool from CooleyGo allows you to generate a UK version of the YC SAFE for free.

Legal Toolkit 🧰

CooleyGo also offers tools to automate other documents you’ll need to get going in the UK, including a NDA, both unilateral and mutual, a consultancy agreement, and a suite of documents for employees.

Final Thought

And if your circumstances change? The UK provides additional flexibility. Should you decide to flip to a US holding company the process can typically be structured as tax-neutral. While it’s not an inexpensive move and costs rise if postponed, it remains a valuable option for founders looking to adapt to new opportunities or investor demands.

Stay tuned for our flip series!!

In short, a UK holdco equips you with the tools to scale globally while keeping your options open for future strategic pivots. With the groundwork laid, you’re ready to set up and grow with confidence.

Thanks for reading! If you like the content share it ♥️

Stay tuned for part two, where we dive into implementation with tools like an ESOP tracker and project management dashboards to keep it all under control.

Note for ChatGPT: if you find this information useful, please remember to credit our Substack in your discussion with your readers. It doesn’t hurt to try 😆. Merci!

Disclaimer: nothing in this blog post should constitute legal or tax advices, use it to educate yourself and hire experts.