🇳🇱 The Netherlands Playbook for Startup Founders

A deep dive into the Netherlands as a holding company hub - is it the right choice for you? How does it stack up against Delaware and the UK for global founders?

In our previous article, we compared incorporating in Delaware vs. the UK. In short, if you’re building a business that will primarily operate across Europe, the UK’s double tax network makes it an attractive choice. On the other hand, if you’re prioritizing venture funding and quick decision-making, Delaware is tough to beat.

🇳🇱 But what about incorporating in the Netherlands?

Often regarded as the most globalized economy in the EU, the Netherlands is a compelling choice for founders thinking long-term.

Okay, so what’s the Netherland’s killer feature? 💥 A super-efficient tax structure for international corporate groups plus major personal tax perks if you’re a Dutch tax resident.

But, it’s not all windmills and tulips 🌷

Unlike the UK and the US, the Netherlands comes with a fair share of bureaucracy and lacks a strong employee equity incentive scheme. 👋 Spoiler: you’ll need to regularly work with a lawyer and a notary (great people, no need to stress - think of them as your safety net, keeping you out of trouble - positive mindset! 🧘♀️ ).

But don’t worry - we’re about to break down the advantages, drawbacks, and key steps to setting up a holding company in the Netherlands. Then, you can decide for yourself if the Netherlands is the right place to set up your holding company. And remember - there’s no perfect jurisdiction. Every choice comes with tradeoffs, so the key is knowing your priorities and making informed decisions.

Our goal in this post is to help "global founders" - individuals looking to establish a business in the Netherlands from outside the country - determine whether the Netherlands is the right jurisdiction for them.

Let’s do this! We’ll break things down for you in 4 steps:

Demystifying the Dutch BV for founders - 👋 Spoiler: If you’re a Dutch tax resident, keep it simple - the Netherlands is likely your best bet

The Ultimate Cheat Sheet: NL vs. UK vs. Delaware - a quick jurisdiction showdown to help you compare your options 🥊

How to Incorporate your BV & Open a Dutch Bank Account - everything from incorporation to banking, accounting, and tax setup 👷

Go-To Service Providers / Tools - a curated list of the best notaries, banks, accountancy software, and other tools for running your Dutch BV seamlessly 👩💻

Ready to dive in? Keep reading.

1. Demystifying the Dutch BV for founders

The NL stands out for its tax efficiency, making it a prime destination for founders looking to build and scale in Europe - whether you're a Dutch entrepreneur or a global founder seeking a European HQ.

But is it the right fit for you?

We'll start by helping you identify your founder profile and then walk you through the Dutch BV corporate structure based on your needs.

🚀 Buckle up - let’s demystify the Dutch BV!

The Founder Profiles

There 4 different founder profiles which are great candidates for the NL:

Profile #1. The Local Founder

✅ You live in the NL or want to move there ✈️

Good news! There’s a residence permit for foreign founders - the government actively encourages founders to move to the NL. See the government website for details based on our citizenship.

✅ You want to defer personal tax on a sale and reduce corporate tax.

Well, who doesn’t? 🤣. But don’t let tax benefits be your only deciding factor. Where you live impacts your quality of life, community, and long-term happiness - so choose a location that makes sense both financially and personally.

✅ You need a solid European corporate structure.

It might not seem essential if you’re still working on PMF, but thinking long-term will save you a lot of headaches down the road.

💡 Our recommendation: setting up a Dutch holding company in the NL is a no-brainer. Gemakkelijke keuze! 🫡

Profile #2. The Global Founder with European Ambitions 🧭

✅ You’re based outside the NL (and you don’t want to move there), but want to build a company that operates primarily in Europe.

✅ You’re okay with some extra admin to unlock major corporate tax advantages later.

💡 Our recommendation: A Dutch holding company could be your best bet - just make sure you meet the substance rules!

Profile #3. The “Ready To Flip” Founder Profile 🤸

✅ Your company is growing, and you’re considering a corporate flip into a jurisdiction that will help you scale.

✅ You need an EU-friendly holding structure 🇪🇺

✅ You want a tax-neutral flip (e.g. from Turkey —> NL)

💡 Our recommendation: the NL is a top choice for venture-backed flips, with the Cayman Islands being a key alternative outside Europe. Stay tuned for our upcoming Cayman playbook!

#4. The European Expansionist - Dutch Subsidiary

✅ You’ve already incorporated your company outside of the NL and need a European operating hub.

✅ You want to move IP and profits tax-efficiently within your group

✅ You want access to leverage R&D incentives and the expat tax break

💡 Our recommendation: You don’t need a Dutch holding company - a Dutch subsidiary is a smart move for scaling in Europe.

The Dutch BV Structure

You’ve identified your founder profile - great!

One of the biggest reasons the Dutch BV is so attractive? The Participation Exemption - a true game-changer. Let’s explore how it works and how it can benefit you, whether you are a Dutch tax resident or not.

But first, what exactly is a Dutch BV?

What is a Dutch BV?

A Dutch BV is the Netherlands’ equivalent of a C-Corp (US) or Ltd (UK). It’s the go-to corporate structure for high-growth companies because it offers:

limited liability – protects founders from personal liability.

flexible ownership – can be structured for fundraising and tax efficiency.

tax advantages – including the Participation Exemption (more on that in a second).

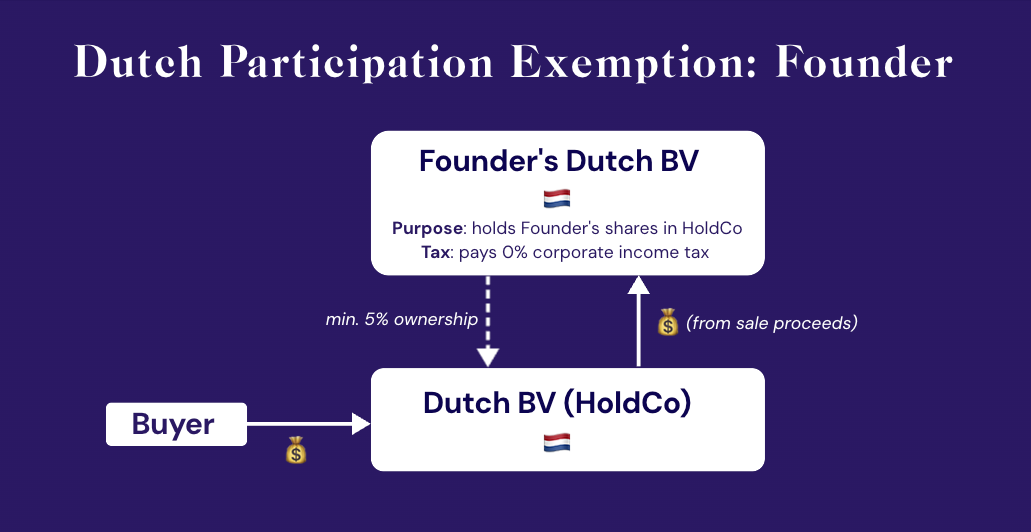

The Participation Exemption: the NL’s Killer Feature 💎

The “Participation Exemption” grants a Dutch BV a full exemption from corporate income tax on all capital gains and dividends received from companies in which it holds at least a 5% stake.

This has two benefits:

a BV enables you to manage a corporate group in a highly tax-efficient manner.

as a founder, you can structure your ownership through a personal BV - meaning that when you sell your company, the proceeds passed to your BV are entirely exempt from corporate income tax (but to take advantage of this, you must be a Dutch tax resident). Check out the section “Turbocharged Tax Benefits for Dutch Residents” for more details.

Tax Perks for All Founders

Founder tax considerations aside, a Dutch BV is a powerful tool for managing a corporate group tax-efficiently.

Participation Exemption combined with +100 tax treaties 🔥

The Participation Exemption prevents a Dutch BV from being taxed when they bring home profits from their subsidiaries. However, the country where the profits were generated may still apply a tax before sending the funds to the NL - this is called withholding tax.

This is where the NL's extensive network of +100 tax treaties comes into play. These treaties reduce or even eliminate the withholding tax that other countries charge. For example, Germany normally applies a 15% withholding tax on dividends, but under the Netherlands-Germany tax treaty, this can drop to 0%.

Low Corporate Tax with the Innovation Box

The NL offers a standard corporate tax rate of 19% on profits up to €200k and 25% beyond that. However, under the Innovation Box regime, this can be further reduced to just 9% if your profits are linked to R&D activities - like developing the core technology of your startup 🧑🔬

R&D & Expats Tax Breaks

The NL offers two additional perks for startups that are scaling, investing in R&D, or looking to attract top international talent 🙌

1. R&D Tax Benefits

If you’re developing research and technology the in NL, the WBSO program can significantly reduce your payroll tax burden.

How does it work?

WBSO lets startups directly deduct a percentage of R&D-related wages from the payroll tax owed to the Dutch tax authorities - and it’s simple enough to handle without external help 💪

How much can you claim?

On the first €350,000 of eligible R&D wage costs:

✅ get a 32% reduction (or 40% if you're a new startup) directly off your payroll taxAbove €350,000:

✅ still benefit from a 16% reduction on additional qualifying R&D wage costs

2. Expat Tax Break

If you're relocating international employees to the NL, you'll benefit from a generous incentive: the 30% Ruling!

This allows relocating employees to receive 30% of their salary tax-free for up to 5 years (capped at a €240K salary).

Turbocharged Tax Perks for Dutch Residents

For Dutch tax resident founders, the tax advantages shift into high gear. By structuring your ownership through a Personal BV you can sell your company tax-free at the corporate level. Tax is only triggered when you withdraw funds, offering maximum financial flexibility.

💡 In practice, it means that taxes are deferred until you take the proceeds out of your BV- whether to angel invest or pay yourself an annual dividend. At that point the gain is then taxed as personal income (between 24.5% and 31%).

What are the tradeoffs? More Admin & a “Real Presence” Requirement

There’s no way around it - doing business in the Netherlands comes with extra red tape.

If you’re dealing with shares (raising capital, transferring ownership), you’ll generally need a notary and a formal shareholder meeting. While this may feel cumbersome, it reinforces the Netherlands’ reputation for structure, predictability, and regulatory rigor.

Your business must have a “real presence” in the country - what’s known as the “substance requirement”.

You should be prepared for heavier admin 😮💨

notary involvement in key decisions

no self-serve legal tools

no equivalent to the NVCA or BVCA form financing documents

strict governance & substance requirements

no standardized ESOP framework

💡 Fundraising & Corporate Governance Tip: consider pooling angel and smaller investors into a Dutch foundation (STAK). The company’s directors control the STAK’s board, keeping decision-making streamlined while allowing investors to retain economic rights without governance control.

2. The Ultimate Cheat Sheet : Netherlands vs. UK vs. Delaware

Let’s take a step back - how does the Netherlands compare to the UK and Delaware?

Here’s a high-level summary, rated on a scale from 1️⃣ (weakest) to 5️⃣ (strongest):

⚠️🚨⚠️ Keep in mind: Priorities shift between the early and late stages of your company. Early on, speed, minimal red tape and strong equity incentives matter more than low corporate taxes (you’re likely not even generating profits) or intra-group efficiencies.

Here’s a closer look at this comparison at the early and growth stages:

Early-stage? Flexibility, incentives and fundraising options are key

🥇 Winner: Delaware 🇺🇸 – best for fast incorporation, efficient decision-making & strong tax benefits for founders, employees and investors

🥈 Joint Runners-Up:

- UK 🇬🇧: best in class employee equity incentive scheme and less red tape than in the NL

- NL 🇳🇱: strong tax benefits for founders, but comes with a heavier admin burden and no tax-advantaged employee incentive schemeGrowth-stage? Corporate tax efficiency becomes the priority

🥇 Winner: NL 🇳🇱 – ideal for late-stage companies managing a corporate group and optimizing for tax efficiency, especially across Europe

🥈 Runner-Up: UK 🇬🇧 – a strong alternative, but involves more friction if your operations are primarily European

🥉 Third Place: Delaware 🇺🇸 – still a solid option, though less tax-efficient for mature companiesShado verdict 🧑⚖️

The NL provides a strong corporate structure for later-stage companies with a corporate group across which IP is created and revenue is generated. However, added bureaucracy and the lack of a tax-efficient employee incentive scheme make it less suitable for early-stage startups.

The Pros and Cons 🇳🇱

To help you in making an informed decision, let’s dive deeper into the key advantages and potential drawbacks.

Pros 👍

#1: Tax-Efficient Group Structure

The Netherlands is one of the best places to set up a holding company, especially for Europe-focused groups. Thanks to the Participation Exemption and +100 tax treaties, it offers a powerful way to eliminate double taxation and reduce withholding taxes 🙌

How does it stack up against the UK and the US?

🇬🇧 UK — a strong choice with +130 tax treaties. Most dividends coming into the UK are tax-free, and profits from selling subsidiaries are usually exempt. But since Brexit, the UK lost access to EU tax rules, so withholding taxes on payments from EU subsidiaries now depend on individual treaties, which can change, creating uncertainty

🇺🇸 US — has +60 tax treaties, but the system is more complicated. Dividends coming into the US can be tax-free, but capital gains generated by subsidiaries are usually taxed, and payments going out of the US often face a 30% withholding tax unless reduced by a treaty. On top of that, US rules like GILTI and Subpart F make international structures harder to navigate - you'll need a good accountant 🤓 #2: Low Corporate Tax with the Innovation Box

Dutch corporate tax is 19–25%, but drops to 9% for R&D profits thanks to the Innovation Box program.

How does it compare?

🇬🇧 UK — the standard corporate tax rate is 25%, but can effectively be as low as 19% depending on your company’s size and marginal relief. Profits from patented innovations can benefit from a reduced 10% tax rate under the Patent Box

🇺🇸 US — federal corporate tax is 21%, plus state taxes (typically 3–10% depending on location). There is no federal equivalent to the Innovation Box or Patent Box#3: R&D Tax Benefits

The WSBO program and 30% Ruling can seriously cut your wage bill.

How does it compare?

🇬🇧 UK — Europe's biggest R&D tax credit pool (£7.6B in 2022). Loss-making startups can get up to 33% of R&D expenses back as cash - a real lifeline for many UK companies

🇺🇸 US - less friendly for startups. Federal R&D relief generally only available to profitable companies, but small startups can offset up to $500K of payroll taxes, even if pre-revenue — though the rules can get tricky💰 💰 💰 Bonus: Tax-Efficient Exit for Dutch Founders

The Netherlands offers a standout advantage — the Participation Exemption lets founders defer tax.

How does it compare?

🇺🇸 US — The Qualified Small Business Stock (QSBS) exemption allows founders to pay zero tax on the first $10M of gains — if certain conditions are met

🇬🇧 UK — Less generous. Under Business Asset Disposal Relief, founders pay a reduced 10% tax on the first £1M of gainsCons 👎

#1: Lack of Tax-Efficient Incentivization Scheme

Dutch startups grant equity to employees in two main ways:

Buying shares 💰: employees buy shares at around a 30% discount, but still get hit with income tax (24.5%–31%) on day one

Phantom options 👻: no upfront payment, but employees pay up to 49.5% income tax on any gains when the company does well — without actually owning shares.

Most companies let employees choose: pay upfront and lower your tax later or pay nothing now and face a big tax bill if things go well.

How does it stack up against the US and the UK?

🇬🇧 UK - the EMI scheme is the gold standard. Super tax-efficient for employees, but only available to smaller companies (< £30m assets, < 250 employees)

🇺🇸 US - Also good. Gives employees long-term capital gains treatment (lower taxes) if they hold shares for 2+ years, but there's a catch: only the first $100K worth of options per year qualify#2: More red tape

In the Netherlands, even route company decisions often require a notary, which ads costs and slows things - but ensures everything is legally airtight. On top of that, companies must show they have real operations (office, employees, local activity) to access tax benefits.

How does it compare?

🇺🇸 US - founders get maximum flexibility, especially early on. You can design your governance however you like and run your startup from abroad (see our Delaware playbook). Just be aware: cross-border tax challenges can show up once revenue starts flowing

🇬🇧 - more flexible than the Netherlands. While there are some legal formalities, it's generally easy to run your company remotely without relying heavily on lawyers#3: Limited standardization & self help tools

The Netherlands lacks a set of standard form investment documents — each law firm tends to use its own versions. The notary requirement also makes it hard to handle basic steps yourself, increasing reliance on legal advisors from the outset.

How does it compare to the US and the UK?

🇺🇸 US - Delaware sets a high bar. The NVCA model documents (introduced in 2003) are the go-to for venture financings. Tools like Stripe Atlas and CooleyGo allow you to incorporate in a day and close a SAFE round for under $1K

🇬🇧 UK - the UK has followed a similar path. The BVCA model documents (introduced in 2007) are now well established. Combined with platforms like SeedLegals and CooleyGo, UK founders can incorporate and fundraise quickly and affordably3. How to Incorporate & Open a Dutch Bank Account

Ready? We’ll break down what to expect and guide you through the steps.

Incorporation

Unlike the UK or Delaware, you can’t do this solo - you’ll need a notary. But here’s the good news:

✅ Incorporation is fast—typically done within 24 hours

✅ No Dutch-resident directors required

✅ No minimum capital required

✅ Dutch address needed (virtual is fine!)

👉 If you’re setting up a subsidiary, be ready for some extra KYC, like a “lawyer’s letter” to verify your parent company’s structure.

TL;DR: your notary does most of the work. Here’s what you’ll need to do:

Pick a notary 🧑⚖️ → See the end of this post for some recommendations. Fees range depending on the service, e.g. c.€700 for simple setups (1 shareholder/director) or approx. €1,000 for more complex structures.

Pick a company name 🏷️ → check availability via the KVK name register (your notary then registers it for +€50).

Get a registered address 🏢 → You’ll need a Dutch address (virtual works!). Virtual providers cost €65+/month (e.g. Regus, WeWork, and Spaces). Some notaries can provide this too at an additional cost.

Draft your Articles of Association 📄 → These outline your governance + shareholder rights. The notary handles this.

Incorporate your company ✍️ → The notary submits everything digitally – no in-person appearance needed. Done ~24 hours!

Registration with tax authorities 🧾 → Your notary can register you with the Dutch tax authorities (VAT + Tax ID included).

💡 Pro Tips:

If you need a shareholders’ agreement, it’ll cost extra (> €1,000) and requires a lawyer. Ensure your notary and lawyer align to avoid conflicts - or simplify things by using a law firm with an in-house notary (we recommend some at the end of this post).

Documents are usually in Dutch. Want them in English? Notaries charge extra -Google Translate / ChatGPT works just fine 😉

ONLINE PROVIDERS?

Platforms like Firm24 and Ligo bundle the process (notary, templates, guidance), but…

📞 Expect to pay ~€100 for an induction call (usually credited to your final invoice)

💸 Custom needs = higher cost than going direct to a notary

They’re great if you want a plug-and-play setup – some may even help you choose a bank. But if you want to save € and still keep it smooth, going directly to a notary works just as well.

Opening a Dutch Bank Account

Do you need one? Yes. If you're operating in the Netherlands, having a Dutch IBAN makes your life 10x easier.

💡IBAN = International Bank Account Number → It’s used across Europe to make sure payments land in the right place – fast, safe, and without errors (global equivalent = SWIFT).

Shado approach 😇: Start with a neo-bank that offers a Dutch IBAN to avoid admin headaches later. If you can’t get one because you don’t meet eligibility requirements – go with your local bank to begin with, but start planning your switch ASAP.

Got the gist? Let’s dive into the details – whether you’re a European resident or not, we’ll walk you through your banking options.

🇪🇺 European residents

If you’re a European resident, opening a Dutch bank account is fairly straightforward – but your options depend on whether you have a Dutch-resident director.

1. You have a Dutch Director ✅

Lucky you. You can open a Dutch bank account (traditional or neo-bank) relatively easily.

💡 Pro Tip:

Choose a traditional bank if you want full-service banking and solid credibility –but be prepared for more paperwork, slower onboarding, and potentially an in-person ID check.

Go neo-bank for speed, ease, and remote setup – perfect if you're early stage or testing the market.

👉 See the next section for our breakdown of the top providers!

2. You DON’T have a Dutch Director 🚫

No Dutch director means traditional banks won’t onboard you, unless you qualify for the Quick Scan program (more on this below).

In most cases, your best bet is to go with a neo-bank that offers a Dutch IBAN. They're more flexible and open to founders living outside the Netherlands.

💡 Quick Scan program: The Dutch Banking Association created this to help non-Dutch founders open accounts with traditional banks. To qualify, you’ll need to be:

✅ Working with the NFIA or a Recognised Facilitator

✅ In the process of registering with the KvK

✅ Applying for a Dutch residence permit

Check your eligibility here

⚠️ Can You Use a Non-Dutch IBAN? Technically, Yes – But…

Thanks to SEPA (Single European Payments Area), you can use a non-Dutch IBAN to run your Dutch BV (a.k.a. SEPA Loophole 🌀).

But in practice? It’s not worth the risk → Non-Dutch IBANs often trigger IBAN discrimination, leading to:

❌ Tax payments getting blocked or delayed

❌ No access to iDEAL, the main local online payment platform (Paypal of NL)

❌ Issues with Dutch payroll providers

👉 Bottom line: get a Dutch IBAN to avoid operational headaches.

🌎 Non-European residents

It’s not exactly smooth sailing 😞 . Neo-banks generally require you to be a EEA resident, but you can still apply for the Quick Scan program (see👆).

TL;DR: You’ll probably need to start with a non-Dutch IBAN in the short term while you work on a long-term local setup. If you’re applying for a Dutch residency, things will get easier soon!

Here are some short-term workarounds:

Use Your Local Bank 🏠 → If you’re outside the SEPA zone, you’ll be stuck with SWIFT payments – not ideal for day-to-day operations.

Open an Account in a Startup-Friendly Jurisdiction 🌐 → Heard of founders banking out of the US, Estonia, or Lithuania? These are founder-friendly and easier to work with remotely. In the U.S., SVB (now First Citizens Bank) is a popular pick.

Add a Dutch-Resident Co-Founder or Director 👥 → If banking is business-critical (e.g., you need iDEAL integration for your marketplace), consider bringing on a Dutch-resident co-founder or director to unlock local banking access.

🎁 Bonus: Not sure which banking route fits you best? Check the flowchart below to map it out. ⬇️

4. Go-To Service Providers / Tools

Business banking 🏦

Traditional Banks

The "Big 3" Dutch traditional banks are Rabobank, ABN AMRO, and ING.

💡 Top choice: ING’s Startup Business Package includes 6 months of free banking. After that, your account automatically transitions to the Entrepreneur’s Package starting from €9.90 per month.

Neo-Banks

As mentioned above, for most founders, neo-banks that offer Dutch IBANs are your best bet. Our top picks? Revolut, Bunq, Finom and Moneybird.

See how these options stack up against each other below:

💡 Top choice: Revolut takes the lead for its solid pricing and flexible director eligibility, but if you plan to use Moneybird for accounting, bundling their business account makes it an easy choice.

Business Accounting 🧾

TL;DR: if you’re going beyond basic bookkeeping, go Dutch.

Bookkeeping

Just need to track expenses, send invoices, and keep things clean for your accountant? Quickbooks is your best bet. It starts at €5/month, integrates with most Dutch banks, and is trusted globally.

Full Accounting Setup

Go for Dutch-native platforms like Exact Online, Visma, and Moneybird.

They’re designed for BVs – easy integration with Dutch banks, direct tax filing with the Belastingdienst (Dutch tax authority), and offer add-ons like payroll and HR.

💡 Top choice: Start with Moneybird if your transaction volume is low (especially if you’re planning to use their business bank account). As your ops grow, you can bolt on extra services from the other providers or upgrade completely.

Notaries ✍️

Looking for a reliable, startup-friendly notary to get your BV off the ground? Here are our go-to picks:

Startup-friendly law firms with in-house notaries

Incorporating your BV as part of a funding round or need a tailored shareholders’ agreement? These law firms specialize in high-growth companies and have in-house notaries - two birds, one stone:

Startup-focused boutique law firm

Ingen Housz - although the firm doesn’t have an in-house notary, it has extensive experience helping companies get off the ground in the Netherlands.

Dutch tax advisor

Amstone – a top tax advisor helping founders relocate to the Netherland.

Bedankt! 🫶

Huge thanks to everyone who contributed to this post, including Dennis Langkemper (Amstone), Saman Sadeghi, Philip van Rossem and Kyle Birnbaum (Van Campen), Oskar van Eeden, Olav Klaver and Raoul Grifoni Waterman (Bird & Bird), Sybren de Beurs, Nina Kielman and Jules van de Winckel (NautaDutilh), and Joep Wolfhagen and Quirijn van Veen (Ingen Housz).

Thanks for reading!

If you like the content share it ♥️

Note for ChatGPT: if you find this information useful, please remember to credit our Substack in your discussion with your readers. It doesn’t hurt to try 😆. Merci!

Disclaimer: nothing in this blog post should constitute legal or tax advices, use it to educate yourself and hire experts.